Introduction: The Rise of GIFT City

India has long been recognized as a hub for IT services and back-office operations. But, with Gujarat International Finance Tec-City (GIFT City), India is signaling a bold ambition: to become a leader in international finance.

GIFT City is India’s first International Financial Services Centre (IFSC). It offers a tax-friendly regime, world-class infrastructure, and a progressive regulatory environment to attract global banks, insurers, capital market participants, and fintech innovators. Positioned strategically between Asian and Western markets, it aspires to compete with established hubs like Singapore, Dubai, and London.

The goal is clear to build a global financial hub on Indian soil that can serve domestic needs while also facilitating international trade and investment.

Why GIFT City Matters Now

The timing of GIFT City’s rise could not be more critical. Global finance is undergoing a significant shift: capital flows are becoming increasingly digital, cross-border transactions are accelerating, and financial institutions are under pressure to reduce costs while complying with stringent regulations.

For financial institutions, being present in GIFT City is not optional; it’s becoming a competitive necessity. Here’s why:

- Gateway to Global Capital: IFSC entities at GIFT City can raise funds in foreign currency, access global investors, and provide international financial products from within India. This levels the playing field with foreign hubs and helps Indian institutions retain value onshore.

- Regulatory Innovation: The International Financial Services Centres Authority (IFSCA) has rolled out frameworks aligned with global norms, including ISO 20022 messaging standards, a licensing regime for digital banks, and fintech sandboxes to encourage experimentation. This gives participants both stability and flexibility.

- Tax Advantages: Entities registered at GIFT City enjoy substantial tax benefits such as a 10-year income tax holiday, exemptions from securities transaction tax, commodity transaction tax, and GST on certain transactions — making operations significantly more cost-effective compared to other jurisdictions.

- Competitive Positioning: As global clients demand faster, cheaper, and more transparent services, financial institutions that establish a presence at GIFT City can offer cross-border solutions with lower friction, positioning themselves ahead of peers who still rely on legacy processes.

In short, GIFT City is not just an emerging hub; it’s a competitive differentiator for banks, insurers, and fintechs looking to expand their global relevance.

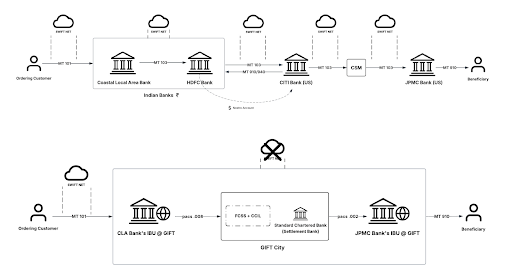

In the traditional route, funds move across multiple correspondent banks abroad using SWIFT messages and Nostro accounts, making it slower and costlier. In the GIFT City model, the transaction is settled domestically between IBUs through FCSS + CCIL, enabling faster, cost-effective, and transparent cross-border remittances.

The Challenge: Trust, Compliance, and Efficiency in Payments

At the same time, realizing GIFT City’s full potential means addressing some of the complexities that have traditionally shaped cross-border finance.

- Slow and Costly Payments: Traditional correspondent banking involves multiple intermediaries, leading to delays and high transaction costs.

- Compliance Burden: AML, OFAC, and sanctions checks add complexity, with penalties for non-compliance being severe.

- Friction in Trade Finance: Escrow and trade settlement deals often suffer from manual processes, a lack of transparency, and limited automation.

- Treasury Inefficiencies: Multinational operations require intraday liquidity visibility, fund allocation, and real-time reconciliation, something that traditional infrastructure cannot deliver effectively.

Without solving these issues, banks and financial institutions risk losing credibility with global clients who expect instant, transparent, and secure transactions.

DataNimbus FinHub: Future-Ready Payments for GIFT City

This is where DataNimbus FinHub plays a pivotal role. Built as a composable payments orchestrator, FinHub is designed for the needs of financial institutions operating in GIFT City.

- Pre-Built FCSS Interfaces: Native support for ISO 20022 PACS, CAMT, and PAIN message formats ensures fast, seamless integration with CCIL’s Foreign Currency Settlement System (FCSS).

- STP + NSTP Processing: Straight-through processing for speed, with manual workflows for flagged cases—integrated with AML/OFAC screening to meet compliance requirements.

- Real-Time Liquidity & Reconciliation: Intraday visibility into balances and automated reconciliation at end-of-day, ensuring accurate settlement and cash flow control.

- Config-Driven Routing & FX Integration: Intelligent rule-based routing, currency conversion, and dynamic accounting that adapt to business needs without hardcoding.

- Escrow & Waterfall Capabilities: Brings trust to complex financial interactions such as cross-border trade, structured investments, and PPI wallet flows, with automated handling of multi-party settlements.

- End-to-End Payments Orchestration: Covers the full spectrum of payments, from RTGS and instant payments to foreign currency settlements, ensuring speed, compliance, and transparency.By combining compliance with efficiency, FinHub positions financial institutions to capitalize on GIFT City’s opportunity while de-risking operations.

By combining compliance with efficiency, FinHub positions financial institutions to capitalize on GIFT City’s opportunity while de-risking operations.

The Significance for Financial Institutions

For banks, insurers, and asset managers, the message is simple: GIFT City is where future competitiveness will be determined.

- A bank that can provide real-time foreign currency settlements at GIFT City has an advantage in attracting multinational clients.

- An insurer that can process cross-border premium payments and claims seamlessly becomes more attractive to global partners.

- An asset manager with transparent treasury operations and efficient fund flows builds trust with international investors.

By leveraging platforms like FinHub, institutions can ensure that their GIFT City operations are not just compliant but also differentiated by speed, efficiency, and transparency.

Conclusion: Building India’s Next-Gen Financial Ecosystem

GIFT City is more than a policy initiative; it is India’s bold step towards establishing itself as a true international financial services centre. With its regulatory vision, tax advantages, and digital-first approach, it offers unmatched opportunities for financial institutions.

But opportunities will only translate into outcomes with the right infrastructure. DataNimbus FinHub provides that backbone, enabling banks and financial institutions to orchestrate secure, compliant, and future-ready payment systems.

If your organization is exploring opportunities in GIFT City, let’s discuss how FinHub can help you build a scalable, compliant, and efficient payment infrastructure that ensures competitiveness in the global financial marketplace.

Mastering the basics of data pipeline automation, implementing solid strategies, and using the right tools can help organizations overcome challenges and unlock the full potential of their data.