AI-Powered Payments Integration

Enable frictionless integration across banking systems and corporate ERPs supporting ISO 20022, MT, EDI, and legacy/proprietary formats, while preserving rich metadata.

Book a Free Demo

A Leading Bank redefined banking experience by seamlessly integrating innovation, technology, and customer-centricity with FinHub Connect

Background

A leading bank with branches across several countries needed onboard corporates supporting any data format with its systems, automate payments, and ensure real-time, secure reconciliation.

Solution

With FinHub Connect, the bank launched its flagship Corporate to Bank (C2B) product, automating file transformations, enabling AI-powered onboarding, and delivering STP — all in under 12 weeks.

Result

Faster client onboarding, error-free payments, real-time visibility, and scalable, compliant operations

Revolutionary Outcomes with finhub.ai Connect

Launch integrations 10x faster with AI-assisted mapping, reusable templates, and zero-code flows — whether it’s bank applications, ERPs, CRMs or other SaaS products.

Gain full visibility across integrations, with real-time dashboards, audit logs, and traceability — ensuring data confidence and compliance.

Stay future-proof with auto-updated templates for ISO, SWIFT, SEPA, and regulatory mandates — no code changes needed.

Onboard new partners, apps, and geographies without re-architecture. Scale effortlessly with stateless, cloud-native modules.

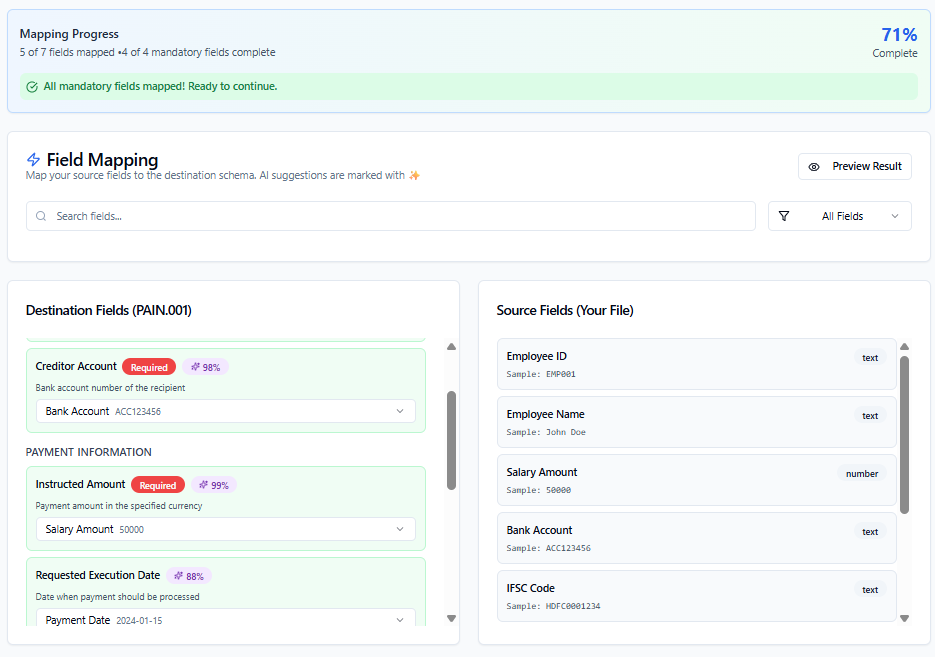

AI-Powered Mapping Assistant

finhub.ai Connect’s field mapping assistant detects, aligns, and transforms even the most complex data formats. AI-suggested matches, real-time validation, and progress indicators turn file setup into a smooth, click-through experience.

Single Control Center

Finhub Connect’s dashboard is your real-time control center, tracking every file, transaction, corporate action, and exception. Stay on top with AI-driven alerts, smart insights, and full system visibility in one intuitive view.

Continuous visibility

Track every file end-to-end with full visibility into status, format, and flow, powered by alerts, format‑specific validations, and audit‑ready traceability.

Use Cases

Corporate-to-Bank (C2B) Data Integration

Corporate-to-Bank (C2B) Data Integration

Enables corporates to accept any data format and protocol while banks adopt, validate, and process them with full straight-through processing (STP) and auditability.

Bank-to-Corporate (B2C) Reporting

Bank-to-Corporate (B2C) Reporting

Transform bank statements (CAMT, MT940, proprietary formats) into corporate-ready outputs tailored for ERPs and TMS systems — with traceability from transaction to report.

Payment Hub & Orchestration Layer

Payment Hub & Orchestration Layer

Act as a smart pre-processor between corporates, fintechs, and banks — routing files, APIs, streams, and messages across payment rails.

ISO Compliant CDM for Banking Integration

ISO Compliant CDM for Banking Integration

Connect modern channels and legacy applications with native ISO 20022 compliant canonical data model that enables modernization.

Features

Natural-Language Rule Builder

Express business rules easily, turning them into live, running integrations instantly.

Universal Data & Protocol Support

Handle any data format or protocol: ISO 20022, CSV, XML, JSON, REST, SFTP, Webhooks from any source to any destination.

Composable, Event-Driven Architecture

Build modular, reusable workflows using APIs, event triggers, and condition-based routing. Scale horizontally with no vendor lock-in.

Real-Time Monitoring & Alerts

Monitor every payment and file flow in real time with intelligent alerts, early error detection, and audit-ready logs

One-Click Deployment

Go from mapping to execution in minutes, deploy flows or partner formats instantly — no dev cycles, no release queues.

AI-powered Format Recognition

Drop any file, finhub.ai Connect uses AI to recognize the structure and transform it into your desired format in seconds.

Self-Service Sandbox

Simulate workflows, test formats, and validate logic with AI-powered suggestions all before going live

Enterprise-Grade Security

Data encrypted in motion and at rest with strict access controls, audit trails, and role-based permissions built in.

Exception Management

Detect validation issues, missing fields, and processing failures in real time — with clear error explanations, retries, and operational dashboards.

Effortless Connectivity

with custom-made

connectors for the enterprise

Access a vast marketplace of ready-to-use connectors for seamless integration with industry applications and leading technologies. Break down data silos, simplify data flow, accelerate deployment, and scale with ease.