Payouts vs payments – and why it’s important to understand the difference

In the world of FinTech, the terms “payments” and “payouts” are often used interchangeably. However, it is crucial to recognize that these concepts are distinct from each other, and product teams are starting to understand their significance and how to address challenges in these areas.

Differences between the two

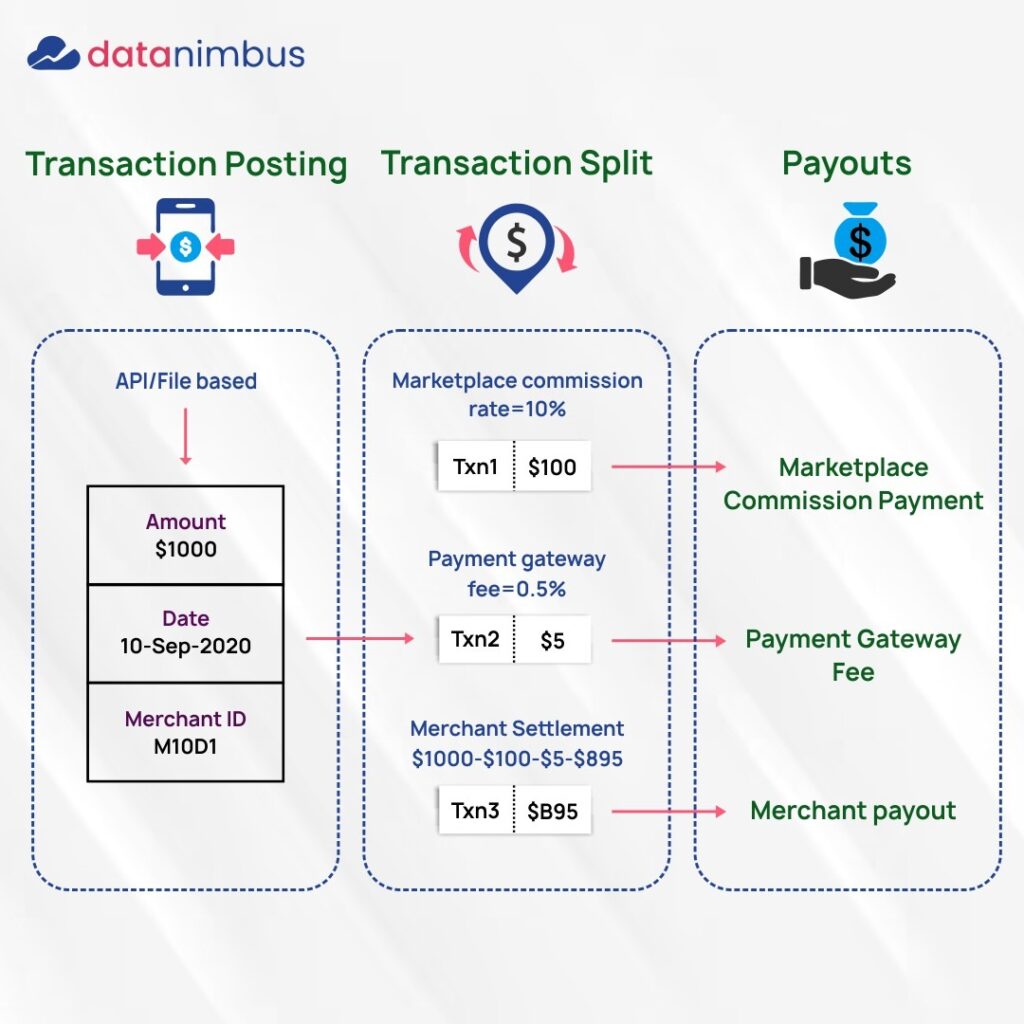

While there may be various interpretations among FinTech professionals, at its core, online payments – particularly in the world of digital commerce – primarily refer to the transactional aspect of transfer of funds, for instance, making a purchase or applying a charge. On the other hand, payouts focus on how the funds collected in a payment are actually settled”paid out” to the ultimate beneficiaries. For example, in an online transaction on UberEats for a $15 sandwich, the payment processed could be split into multiple tranches allocated to the restaurant, the delivery partner, and pay fact/payment gateway commissions.

What's special about payouts?

[1] Multi-party: a payout is almost always associated with a beneficiary who “participates” in a transaction, e.g. a merchant, a logistics partner, an online marketplace, etc. A big part of orchestrating payouts involves onboarding and managing the lifecycle of these participants and applying business rules specific to them.

[2] Scheduling: Payouts can occur instantly, or T+1, or based on a schedule (the 5th of every month). This requires banks to deal with future dated payouts, with the possibility of holding payouts if there are risks (such as a KYC expiration of a merchant, or abnormally high refunds/chargebacks). Future dated payouts enable financial institutions to earn float revenue on otherwise non-interest bearing accounts where the funds are held.

[3] Netting: Multiple payouts are usually grouped or clubbed together into one payout to simplify accounting and reduce load on the core systems. While partners may be paid instantly, imagine Uber earning a $2 commission for every ride; a million rides will typically result in one large end-of-day / end-of-week payout. This creates a reconciliation problem (what are those underlying tranches that represent a full payout?) that needs to be addressed via MIS and dashboards.

Why are payouts so important?

The answer is simple: without the ability to orchestrate payouts, banks and fintechs cannot easily enable earnings in the gig economy. Millions of gig workers strive hard to earn a side-hustle today without owning assets, and that’s primarily possible thanks to the emergence of frictionless payments in a gig economy that enables an unprecedented level of convenience (from delivery and courier to HVAC servicing).

“Processing the transaction, well, that’s the easy part. The movement of funds — what happens before and after the transaction takes place — that’s the hard part.”

The sheer volume, velocity and versatility of payouts continues to increase. Meanwhile, financial institutions continue to build more complexity to deal with regulatory or business requirements. Stitching it all together to make a risk-free frictionless payout is what most commercial banks are looking for, with an intent to grow their liabilities balance, fees (direct revenue) and float (indirect revenue).

Sophisticated payout workflows necessitate the ability to incorporate regulatory compliance, manage liquidity, and apply payout preferences as rules, which are defined by the aggregator and beneficiary. Enterprises are now solving this globally; Standard Chartered Bank launched an offering in September 2022 called Payouts-as-a-Service to tackle all of this. Click here to read more about this.

Click here to learn all about how your financial institution or enterprise can implement payouts at scale.

FAQs

– Online marketplaces: split into payouts for merchants, delivery partners and the aggregator

– e-toll gates: split into payouts for toll operator, road/transport authorities, consortium of lenders who helped fund the infrastructure project

– Food delivery: split into payouts for restaurants, delivery partners and the aggregator

– EV charging: split into payouts for charging operator, automotive manufacturer

– Rideshare: split into payouts for driver/partner and rideshare aggregator

… and many, many more, only limited by human creativity to create alternate, frictionless models in the gig economy.