The advent of digital commerce has created new avenues of business models, as well as new complexities of accounting. Merchant settlement and payouts have long benefited from the ability to do “payment splits” to calculate commissions/fees and “pay them out” separately. However, one of the big trends with FinTechs and ISVs (independent software vendors) participating in the transaction is the need to influence these payouts in a smarter way, creating a need for “programmatic payouts”.

What Are Programmatic Payouts?

To understand programmatic payouts, it’s helpful to first understand how traditional settlement works. Typically, merchant settlement involves the settlement of money that a payment entity (usually a payment gateway/bank) receives into its escrow, nodal or FBO (for-benefit-of) / DDA (demand-deposit) account, which ultimately needs to be paid out to the merchant.

Under normal circumstances, the payment gateway deducts the acquiring fees (e.g. credit card fees) and the remaining merchant fees are netted together into one payout and paid to the merchant. At this point, any additional calculations/splits to support new business models are done manually, which are both tiresome and, more importantly, heavy with risk.

Business scenarios that drive payouts

New business models continue to emerge that require a more sophisticated, nuanced movement of money. Let’s consider four distinct scenarios:

– EV charging payments: Ford and Tesla announced a partnership that requires both parties to calculate commissions for every charge, apply nuanced split rules and work out whom to pay and how much to pay as part of their overall strategy, including state-specific or county-specific rules.

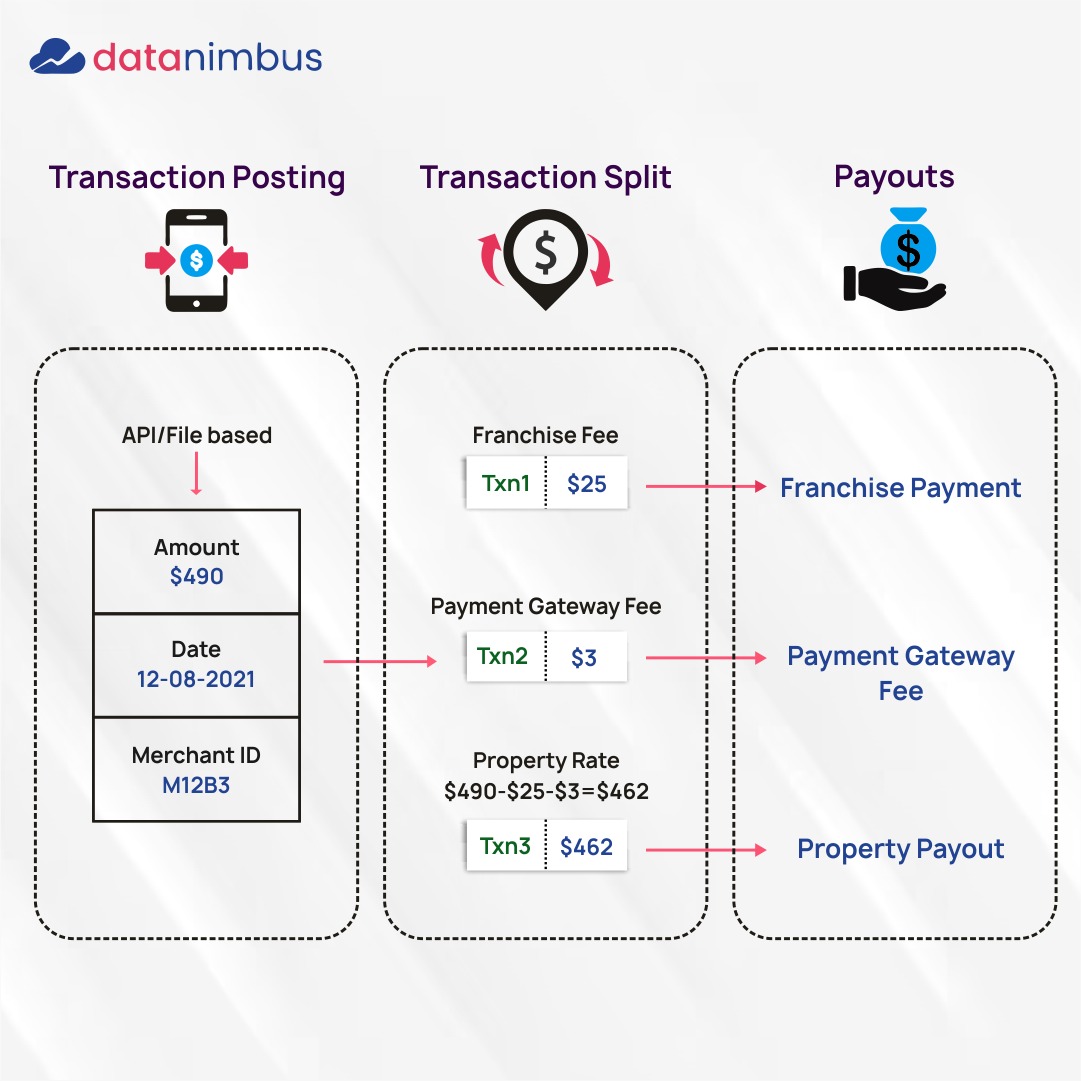

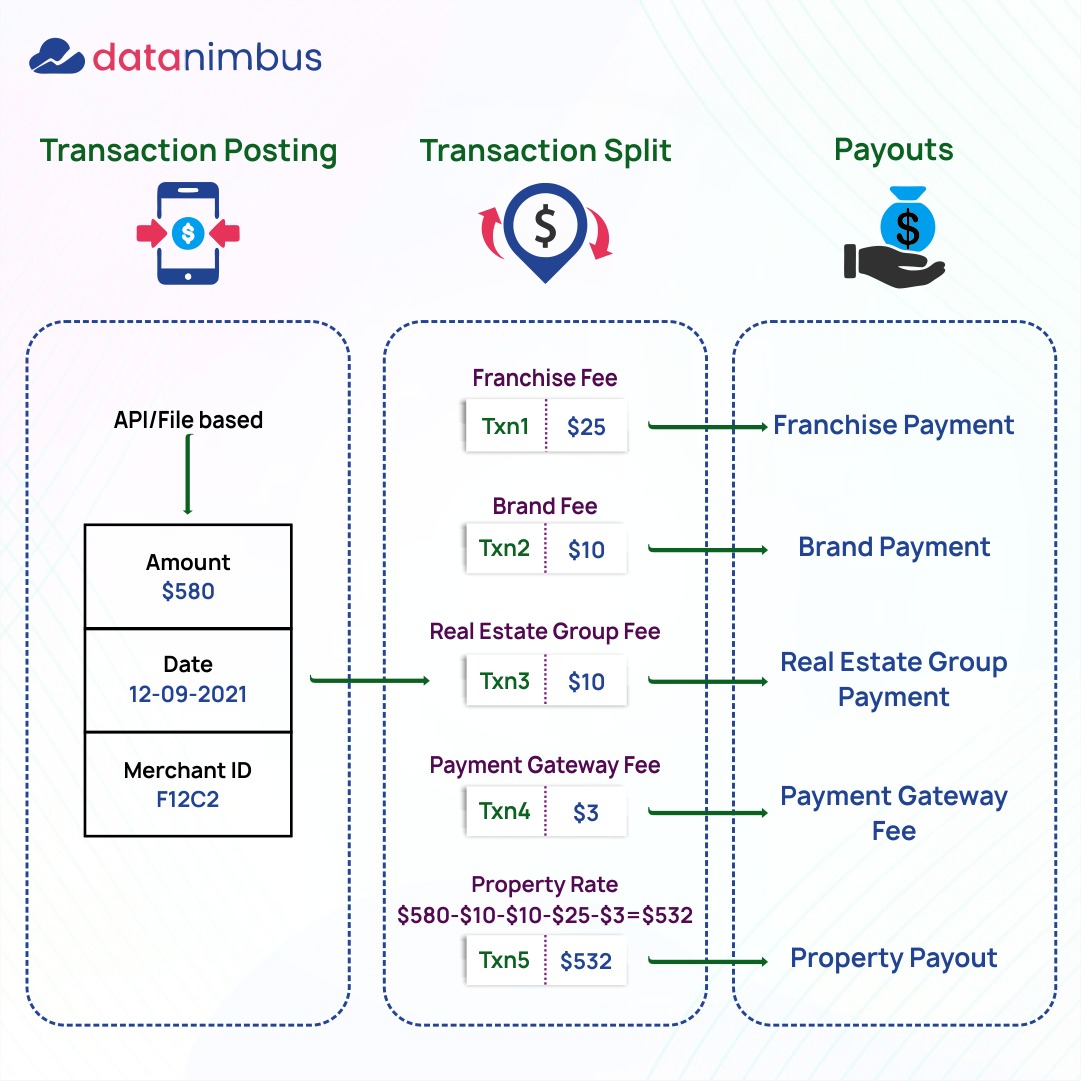

– The franchise model: payments collected in an entity as part of a franchise (such as a St. Regis property, part of the Marriott group) may involve multiple splits; fees to the property, royalties to the brand, commissions to the franchise and so on.

– Cross border payouts: Business models that result in merchants being paid in multiple countries will have separate payment preferences per payout, on cross border charges, purpose of payment, etc.

– Donations to causes and nonprofits: in several online transactions, customers have an option to pay a small fee/donation to a cause

In all these scenarios, the payment splits can happen on a variety of factors: percentage of transaction, flat fees, a combination of the two, as well as more complex and sophisticated rules driven by data points in the transaction. For instance, a merchant may accept cross border fees for all their settlements, except where they are dealing with a high-value temperature-sensitive shipment (for instance, expensive wine that requires a premium/white-glove shipping service) in which case they would collect a separate commission and not forego their charges.

Components of Programmatic Payouts

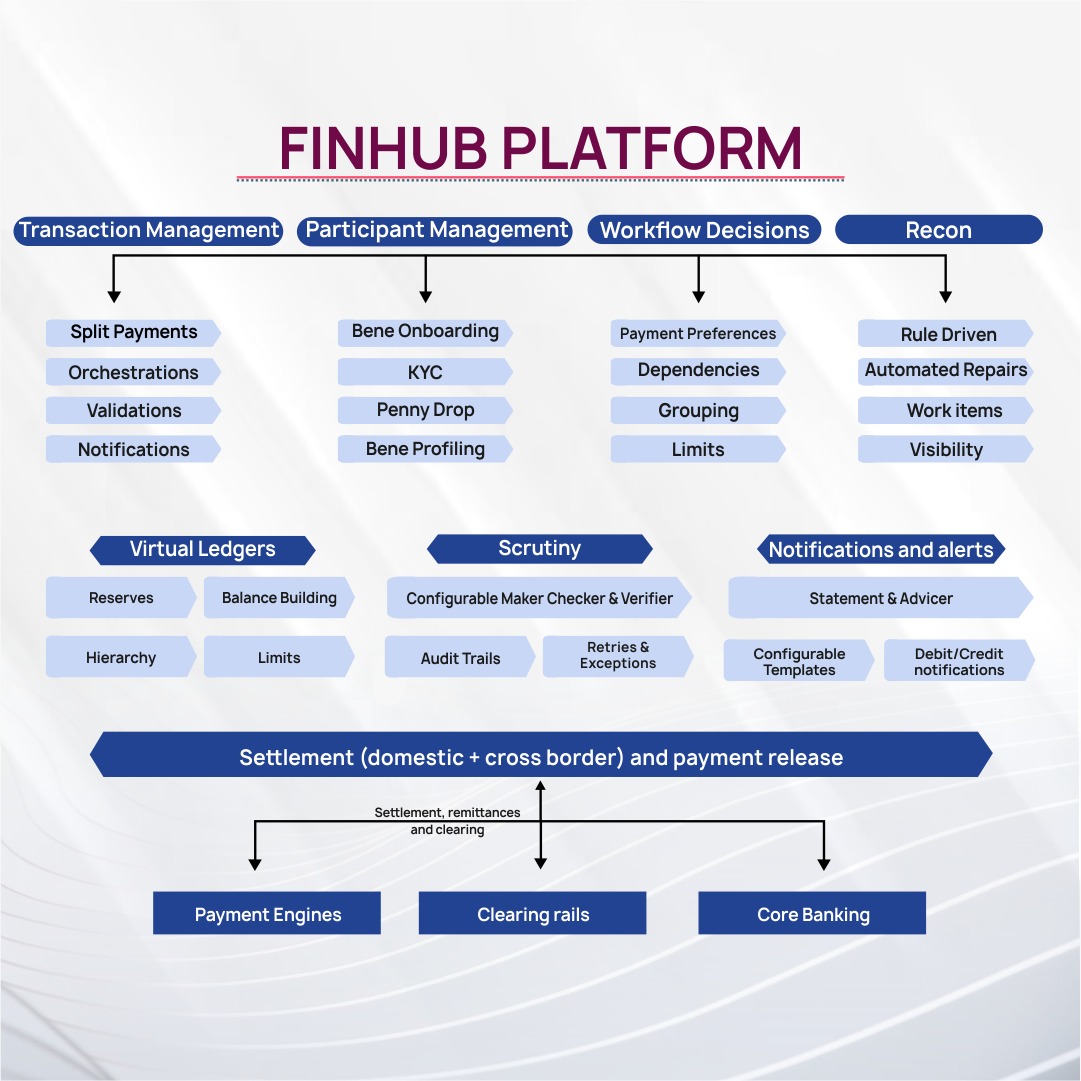

Programmatic payouts are automated digital payments made through specialized software. They enable businesses to pay multiple recipients at once without manual processing. Key components include:

- APIs (Application Programming Interfaces): These facilitate communication between different software systems.

- Platforms: Various online platforms offer services to set up and manage programmatic payouts.

- Payment Gateways: These channels transfer the money securely.

How are Programmatic Payouts applied?

The illustration below examples a simple programmatic payout scenario of a franchise model:

What aspects of settlement can a programmatic payout influence?

These can vary from use-case to use-case. Typically, programmatic payouts influence the following aspects of settlement

– The payout splits themselves (whom to pay)

– Commission/fees (how much to pay)

– Settlement date (when to pay)

– Which accounts and by what rails (where to pay, and whether to pay faster v cheaper)

– Charges (if the rails incur charges and/or if they’re cross border)

Why is automation key to programmatic payouts?

Getting Started with Programmatic Payouts?

FAQs

What are payouts?

Payouts refer to the settlement of funds in a commerce transaction to a merchant/gig workers/biller. For more information on the difference between payouts vs payments, click here.

How is security implemented?

Are programmatic payouts the same as payment APIs?

Are there real-world examples of programmatic payouts that are available?

Standard Chartered Bank launched payouts as a service in Singapore FinTech Festival, in November 2022. Click here to read in detail.

Across the pond, Paya in the US also enables a similar model with what they call “Flexible Funding”. Read here.

What volumes are we talking about here?

Payouts can be very high in terms of volumes; millions of transactions an hour is what most systems need to cater to. The largest payment companies in the world, such as Stripe, are known to process 20,000 transactions per second. Click here to read more.